Flaws in SAAS offerings and the inherent risksWhat if dozens (even hundreds) of banks all used one vendor's solution to provide online banking services?

What if that solution had a security flaw thus affecting all users of said solution? A finding of considerable concern, yes?

I must preface this discussion with the fact that the vendor in question has proven to be trustworthy, capable, reputable, responsible, and responsive.

Precision Computer Systems, a

FISERV company, provides outsourced online banking solutions to a

plethora of banks.

My desire to discuss the vulnerability with Precision Computer Systems (PCS) was forwarded to FISERV for consideration, and the reply came directly from the Vice President | Head of Security.

"As you might imagine, no higher priority exists for our organization than the protection of our client’s information, and that of their customers. To that end, we’ll always welcome constructive feedback such as yours with enthusiasm."As responses to reported vulnerabilities go, PCS/FISERV handled the process in ideal fashion and are to be applauded for doing so.

While flaws in web applications are a dime a dozen, and nearly every web app yields a vulnerability at some point, the more important piece is how the vendor responds when said vulnerability is disclosed to them.

For this software as as service (

SAAS) offering, while each bank's web site is unique, when the user decides to login to the Online Banking service, they're redirected to https://ibank.pcs-sd.net/onlinebanking8/login.r?t-bank=

bank id.

Thus, all banks utilizing PCS for this particular feature all take advantage of this specific application to handle logins, amongst other things.

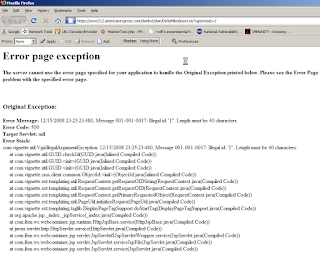

The login form, in particular, suffered from a cross-site scripting (XSS) vulnerability; as discussed in earlier

posts, the potential risks to consumers are obvious.

This graphic has specific bank information redacted, and the specifics of the vulnerability are unnecessary. My preference is to treat this discussion as a learning opportunity, rather than nitpick needlessly.

This graphic has specific bank information redacted, and the specifics of the vulnerability are unnecessary. My preference is to treat this discussion as a learning opportunity, rather than nitpick needlessly.At the risk of overstating the point, the one flawed variable affected all PCS customers utilizing the service.

Again, PCS/FISERV, as indicated above, handled this vulnerability quickly and admirably; they immediately assigned a PM and development resources to repair and release a fix to production.

The lessons here are many.

1) Other online finance vendors, particularly those falling in the SAAS category, take note: this is how to respond to reported vulnerabilities.

2) SAAS customers, take note: ensure that the vendor you contract with for service is very clear about their secure development practices. Don't be afraid to ask very pointed questions such as:

"How quickly will you respond if a vulnerability is disclosed to you?"

"Do you employ a Secure Development Lifecycle standard?"

"How often, and by whom, is the security posture of your product reviewed, preferably with the appropriate compliance frameworks (PCI, SOX) in mind as well as the given web application security standards (input validation, sanitize output, etc.)?"

3) Customers and vendors alike: trust no trustmark (security badge) provider to actually provide you any actual security value...conversions yes, security not so much.

At least one bank on the PCS customer list utilize the likes of Control Scan. You'd think Control Scan might have found or reported this vulnerability to the bank or PCS, yes? I think not. SSL-related trustmarks are also nice but no encryption in the world will help you under these circumstances.

The responsibility bestowed upon SAAS providers is of a magnitude at least similar to that of typical application product providers, if not more.

Where a single "boxed" product falls under the scrutiny of vulnerability managers such as

CVE and

OSVDB, no such scrutiny exists for SAAS offerings.

As more enterprises take advantage of SAAS and cloud-based offerings, they do so for obvious cost and efficiency reasons, but may not have assessed the changing dynamic of their risk posture.

As we consider the premise of

one flaw to rule them all, vendor response will be paramount. May the PCS/FISERV standard become commonplace.

del.icio.us |

digg |

Submit to Slashdot